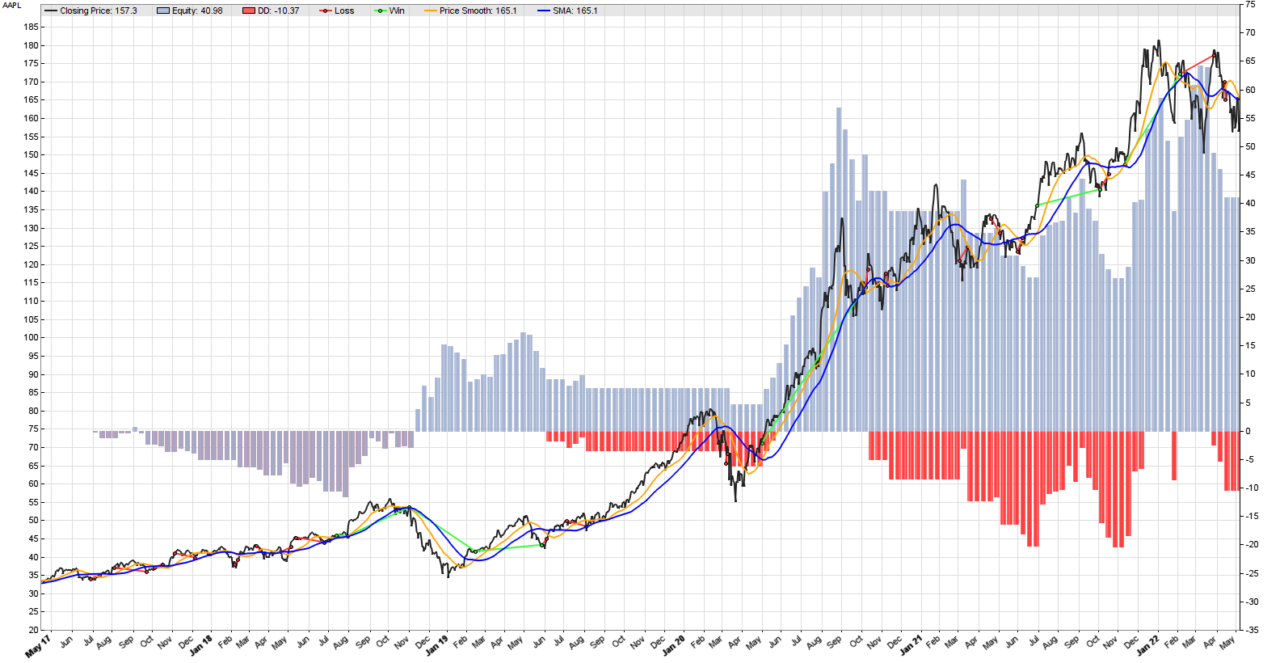

We found that our two moving averages trend following systematic strategy works better with a simple stop loss, or at least it works better on MSFT. In this post, we will experiment with AAPL and SPY. If the new strategy generates improved performance on these securities as well, we may consider this an indication that we are up to something here, and further investigating this strategy makes sense. If not, then we would like to know why. So we will back-test the strategy again in Zorro Trader, but this time for AAPL and SPY. Let’s start with Apple, Inc. The Lite-C code is the same, and the result is in the picture above. The detailed performance review is below.

Test WithStopLoss AAPL, Zorro 2.444 Simulated account AssetsFix Bar period 24 hours (avg 2087 min) Total processed 1953 bars Test period 2017-04-28..2022-05-06 (1265 bars) Lookback period 80 bars (23 weeks) Montecarlo cycles 200 Simulation mode Realistic (slippage 5.0 sec) Avg bar 175.3 pips range Spread 10.0 pips (roll 0.00/0.00) Commission 0.02 Contracts per lot 1.0 Gross win/loss 92.68$-51.71$, +4097.6p, lr 60.50$ Average profit 8.16$/year, 0.68$/month, 0.0314$/day Max drawdown -20.46$ 49.9% (MAE -39.42$ 96.2%) Total down time 71% (TAE 50%) Max down time 80 weeks from Oct 2020 Max open margin 172$ Max open risk 5.28$ Trade volume 2108$ (420$/year) Transaction costs -2.60$ spr, -2.48$ slp, 0$ rol, -0.52$ com Capital required 188$ Number of trades 26 (6/year) Percent winning 26.9% Max win/loss 42.51$ / -5.29$ Avg trade profit 1.58$ 157.6p (+1324.0p / -272.1p) Avg trade slippage -0.0955$ -9.6p (+5.4p / -15.1p) Avg trade bars 26 (+65 / -11) Max trade bars 110 (31 weeks) Time in market 54% Max open trades 1 Max loss streak 8 (uncorrelated 12) Annual return 4% Profit factor 1.79 (PRR 0.91) Sharpe ratio 0.38 (Sortino 0.40) Kelly criterion 3.35 Annualized StdDev 11.38% R2 coefficient 0.657 Ulcer index 29.6% Scholz tax 11 EUR Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 2017 -0 -1 1 -2 -1 -0 -1 -3 2018 0 -1 -1 1 -2 -0 0 5 -0 -1 6 3 +9 2019 -1 -0 2 1 -3 -1 1 -2 0 0 0 0 -3 2020 0 0 -1 0 4 6 8 12 -7 -3 -2 0 +17 2021 0 0 -2 -1 -1 -2 5 3 -5 -2 9 7 +9 2022 -1 3 -7 -3 0 -8 Confidence level AR DDMax Capital 10% 5% 7 177$ 20% 5% 8 178$ 30% 5% 9 179$ 40% 5% 10 180$ 50% 4% 12 182$ 60% 4% 14 183$ 70% 4% 16 184$ 80% 4% 20 187$ 90% 4% 24 190$ 95% 4% 25 192$ 100% 4% 40 203$ Portfolio analysis OptF ProF Win/Loss Wgt% AAPL .999 1.79 7/19 100.0 AAPL:L .999 4.07 5/8 148.5 AAPL:S .000 0.38 2/11 -48.5

This sounds like very good news. Compared with the very first version of the strategy, our Annual Return is up to 4%, which is an increase of 400% from the initial 1%. The original Sharpe Ratio was 0.07, and now it is 0.38, a whooping increase of over 500%. It appears that the smoothing of the price curve and the stop loss are doing a great job on the AAPL as they did on MSFT. Now let’s explore what happens when we run it on the SPY.

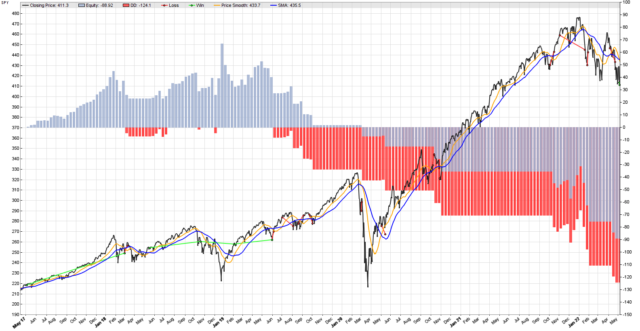

Equity curve of the strategy on SPY

Oops! Things do not look good at all. It appears that we are losing money, although in the beginning we did make some profits. Something clearly changed in June 2019. Until that point everything was working as expected, and then the strategy stopped working. This warrants some further exploration, because algorithmic trading strategies always do that. They do work, until they stop working. And we need to be prepared for that. But this topic is beyond the scope of this post.

Zorro Trader performance strategy report

Test WithStopLoss SPY, Zorro 2.444 Simulated account AssetsFix Bar period 24 hours (avg 2087 min) Total processed 1953 bars Test period 2017-04-28..2022-05-06 (1265 bars) Lookback period 80 bars (23 weeks) Simulation mode Realistic (slippage 5.0 sec) Avg bar 357.1 pips range Spread 10.0 pips (roll 0.00/0.00) Commission 0.02 Contracts per lot 1.0 Gross win/loss 45.09$-132$, -8645.2p, lr -97.84$ Average profit -17.22$/year, -1.43$/month, -0.0662$/day Max drawdown -124$ -143.6% (MAE -156$ -180.2%) Total down time 67% (TAE 43%) Max down time 213 weeks from Jun 2019 Max open margin 459$ Max open risk 13.89$ Trade volume 5759$ (1147$/year) Transaction costs -1.80$ spr, 0.57$ slp, 0$ rol, -0.36$ com Capital required 555$ Number of trades 18 (4/year) Percent winning 27.8% Max win/loss 30.43$ / -14.08$ Avg trade profit -4.80$ -480.3p (+901.7p / -1011.8p) Avg trade slippage 0.0315$ 3.1p (+20.4p / -3.5p) Avg trade bars 33 (+94 / -10) Max trade bars 208 (60 weeks) Time in market 48% Max open trades 1 Max loss streak 12 (uncorrelated 11) Annual return -3% Profit factor 0.34 (PRR 0.15) Sharpe ratio -0.61 (Sortino -0.55) Kelly criterion -11.73 Annualized StdDev 5.22% R2 coefficient 0.000 Ulcer index 100.0% Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 2017 0 0 1 0 1 1 1 1 +5 2018 3 -2 -2 0 -0 0 2 2 0 -2 -1 4 +4 2019 -3 1 1 2 -3 -1 0 -2 -1 -1 0 0 -9 2020 0 0 -2 0 -1 0 0 0 0 -4 0 0 -7 2021 0 0 0 0 0 0 0 0 0 -2 -1 4 +0 2022 -7 0 0 -2 0 -9 Portfolio analysis OptF ProF Win/Loss Wgt% SPY .000 0.34 5/13 100.0 SPY:L .000 0.64 3/6 26.1 SPY:S .000 0.07 2/7 73.9

These results do not look good at all. We are losing, on average, 3% per year. The Sharpe Ratio is negative, which is terrible. However, these are both calculated as averages, and the equity curve of the strategy shows us a very important thing: something changed in June 2019, and the strategy started to make losses. Maybe the moving average formation periods were appropriate until June 2019, and inappropriate after that? Or maybe the stop loss became to tight for the later market regime, or too loose? Or all of the above?

Answering these questions is crucial for any successful algorithmic trading operation, as any systematic trading strategy, on any asset will eventually stop working. And at that time we will need to know if we need to adjust it, or to discard it. Learn more in our video courses in the members area.

by Algo Mike

Experienced algorithmic and quantitative trading professional.