We will try to back-test our simplest trend following strategy in Zorro Trader for two more underlying assets. We selected Apple, Inc. (AAPL) and Microsoft Corp. (MSFT) because both exhibited fairly long and sustained trends in the past, so they should be suitable for any trend following strategy. Our simplest systematic trend following strategy did not perform very well on the SPY ETF, and we want to compare the performance with these stocks. Here is the full code of the strategy again:

function run()

{

BarPeriod = 1440;

vars price = series(priceClose());

vars sma = series(SMA(price, 50));

if(crossOver(price, sma)) enterLong();

if(crossUnder(price, sma)) enterShort();

plot("SMA", sma, LINE, BLUE);

}

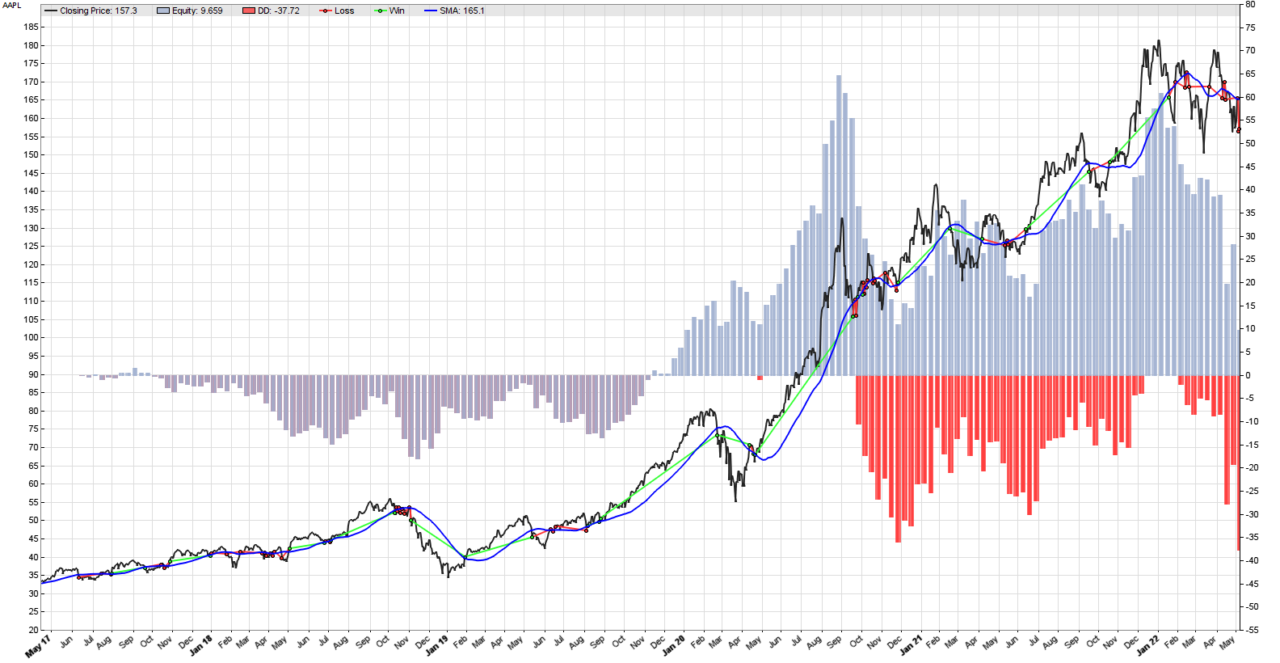

Please note that you need to select the ticker you want to back-test from Zorro Trader’s drop down menu, and both stocks need to have an entry in the AssetsFix.csv file. Of course, historical data for both need to be downloaded in advance, using Zorro Trader’s Download.c script, available already as a tool. Please see our Zorro Trader introductory videos in the members area for details. Compiling and running the code for the AAPL stock generates the results in the image above.

Performance analysis on AAPL

Test SimpleStrategy AAPL, Zorro 2.444 Simulated account AssetsFix Bar period 24 hours (avg 2087 min) Total processed 1953 bars Test period 2017-04-28..2022-05-06 (1265 bars) Lookback period 80 bars (23 weeks) Montecarlo cycles 200 Simulation mode Realistic (slippage 5.0 sec) Avg bar 175.3 pips range Spread 10.0 pips (roll 0.00/0.00) Commission 0.02 Contracts per lot 1.0 Gross win/loss 142$-133$, +891.9p, lr 57.60$ Average profit 1.78$/year, 0.15$/month, 0.0068$/day Max drawdown -38.46$ 431.3% (MAE -65.23$ 731.4%) Total down time 75% (TAE 92%) Max down time 97 weeks from Jul 2017 Max open margin 173$ Max open risk 1.85$ Trade volume 6839$ (1362$/year) Transaction costs -8.10$ spr, 0.23$ slp, 0$ rol, -1.62$ com Capital required 202$ Number of trades 81 (17/year) Percent winning 19.8% Max win/loss 37.71$ / -9.36$ Avg trade profit 0.11$ 11.0p (+888.1p / -204.9p) Avg trade slippage 0.0028$ 0.3p (+10.7p / -2.3p) Avg trade bars 15 (+50 / -6) Max trade bars 124 (35 weeks) Time in market 98% Max open trades 1 Max loss streak 11 (uncorrelated 23) Annual return 1% Profit factor 1.07 (PRR 0.71) Sharpe ratio 0.07 (Sortino 0.06) Kelly criterion 0.46 Annualized StdDev 14.43% R2 coefficient 0.081 Ulcer index 54.8% Scholz tax 2 EUR Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 2017 0 -1 2 -1 -1 0 -0 -1 2018 -0 -0 -2 -3 -0 -1 0 5 -0 -6 1 2 -3 2019 -1 1 2 1 -0 -4 2 -3 2 3 2 3 +9 2020 2 2 2 -3 3 6 7 11 -16 -5 -7 7 +8 2021 -0 4 -0 -1 -3 0 4 3 -1 -3 8 6 +17 2022 -6 -5 1 -5 -9 -25 Confidence level AR DDMax Capital 10% 1% 13 182$ 20% 1% 15 184$ 30% 1% 17 186$ 40% 1% 18 187$ 50% 1% 21 189$ 60% 1% 24 191$ 70% 1% 27 193$ 80% 1% 31 196$ 90% 1% 36 201$ 95% 1% 44 207$ 100% 1% 62 220$ Portfolio analysis OptF ProF Win/Loss Wgt% AAPL .436 1.07 16/65 100.0 AAPL:L .999 2.08 12/28 738.7 AAPL:S .000 0.21 4/37 -638.7

The results for the AAPL back-test are even worse than for the SPY. We make less in profits, and take on even more risk. And the problem seems to be exactly the same: the nice profits we make during the sustained trends are eaten up by lots and lots of small loosing trades during the periods when the price goes sideways. It appears that changing the underlying asset did not do much to improve our results, so we need to think of something else to improve our simple systematic strategy. Just to confirm the idea, we are running the back-test again, this time for MSFT. Here are the results:

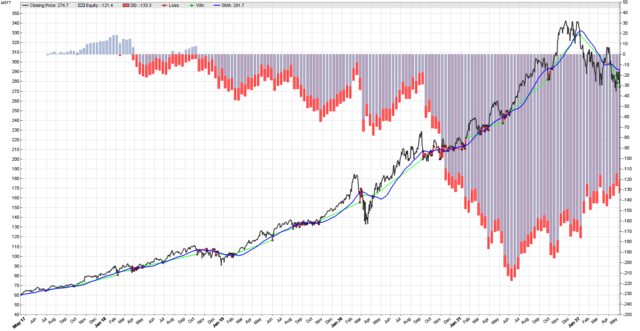

The effect we noticed, a few big wins and a lot of small losses, can rarely be seen as clearly as here. Our simple strategy catches all the major moves of the Microsoft stock, but bleeds all the profits to death during narrow trading ranges. We end up loosing money (negative Annual Returns), taking on a lot of risk (negative Sharpe Ratio), and an absolutely horrible equity curve.

Performance analysis on MSFT – Zorro Trader

Test SimpleStrategy MSFT, Zorro 2.444 Simulated account AssetsFix Bar period 24 hours (avg 2087 min) Total processed 1953 bars Test period 2017-04-28..2022-05-06 (1265 bars) Lookback period 80 bars (23 weeks) Simulation mode Realistic (slippage 5.0 sec) Avg bar 324.8 pips range Spread 10.0 pips (roll 0.00/0.00) Commission 0.02 Contracts per lot 1.0 Gross win/loss 224$-343$, -11862.8p, lr -201$ Average profit -23.63$/year, -1.97$/month, -0.0909$/day Max drawdown -220$ -185.8% (MAE -230$ -193.9%) Total down time 83% (TAE 93%) Max down time 242 weeks from Feb 2018 Max open margin 328$ Max open risk 3.40$ Trade volume 18774$ (3739$/year) Transaction costs -11.10$ spr, 2.00$ slp, 0$ rol, -2.22$ com Capital required 499$ Number of trades 111 (23/year) Percent winning 16.2% Max win/loss 37.97$ / -14.08$ Avg trade profit -1.07$ -106.9p (+1244.2p / -368.4p) Avg trade slippage 0.0180$ 1.8p (+25.6p / -2.8p) Avg trade bars 11 (+50 / -3) Max trade bars 105 (30 weeks) Time in market 97% Max open trades 1 Max loss streak 21 (uncorrelated 30) Annual return -5% Profit factor 0.65 (PRR 0.45) Sharpe ratio -0.46 (Sortino -0.43) Kelly criterion -4.33 Annualized StdDev 10.59% R2 coefficient 0.643 Ulcer index 100.0% Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 2017 -0 0 0 -0 2 0 0 +3 2018 2 -1 -3 -3 1 -0 1 1 0 -2 -2 -2 -7 2019 -2 1 1 2 -1 -0 0 -3 -2 -2 2 1 -3 2020 2 -3 -4 1 1 4 0 4 -8 -7 -7 1 -15 2021 -6 0 -9 3 -7 3 3 3 -3 4 -0 -0 -9 2022 2 2 1 2 1 +8 Portfolio analysis OptF ProF Win/Loss Wgt% MSFT .000 0.65 18/93 100.0 MSFT:L .999 1.36 14/41 -38.7 MSFT:S .000 0.24 4/52 138.7

Clearly, we need a solution to this “death by a thousand cuts” problem, which plagues pretty much all trend following strategies. If we could somehow get rid of the small loosing trades, or not trade during trading ranges, this wouldn’t be such a terrible systematic trading strategy. But is this even possible? And how? We will explore these issues in a video course, available in the members area.

by Algo Mike

Experienced algorithmic and quantitative trading professional.