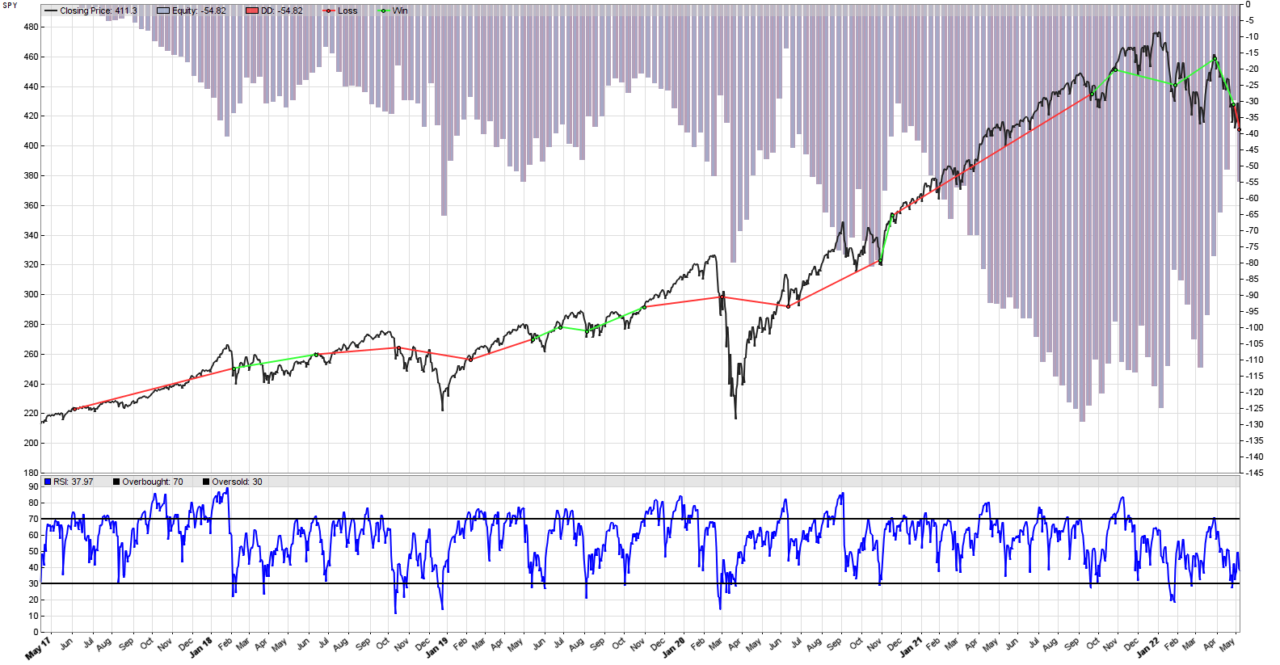

Some assets (like commodities and stocks) tend to trend more than others (like FOREX pairs). In order to investigate the performance of our simplest RSI mean reversion strategy, we will run a Zorro Trader back-test on the EUR/USD pairs. This pair is supposed to mean revert much more than the SPY exchange traded fund. The result of trading the strategy on the SPY is in the back-test equity curve picture above. Not so good during trends, but pretty good in trading ranges.

The rationale of choosing the EUR/USD pair is an economic principle. Both the European Union and the United States have developed economies. The economic performance of both economies is reflected in the exchange rate of their currencies. The ratio of the two currencies does fluctuate, as it is influenced by a myriad of small micro-economic events. However, unless nothing major disrupts this “equilibrium”, the pair should exhibit mean reversion properties. Over time, the SPY always goes up. But there is no reason for the EUR/USD pair to do the same, because both economies are usually doing well.

Full code of the mean reversion strategy in Zorro Trader

function run()

{

BarPeriod = 1440;

MaxLong = MaxShort = 1;

var overbought_level = 70;

var oversold_level = 30;

vars price = series(priceClose());

vars rsi = series(RSI(price, 10));

if(crossOver(rsi, oversold_level)) enterLong();

if(crossUnder(rsi, overbought_level)) enterShort();

plot("RSI", rsi, LINE|NEW, BLUE);

plot("Overbought", overbought_level, LINE, BLACK);

plot("Oversold", oversold_level, LINE, BLACK);

}

Please note the placement of the line of code where we initialize the MaxLong and MaxShort internal variables. It comes right after the BarPeriod internal variable. You should always keep your Zorro Trader internal variable initializations together, at the beginning of your code. This makes them easier to find and change. The program may work even if you scatter some of them around your code, but even if it works, it is bad programming practice. Please do not do it!

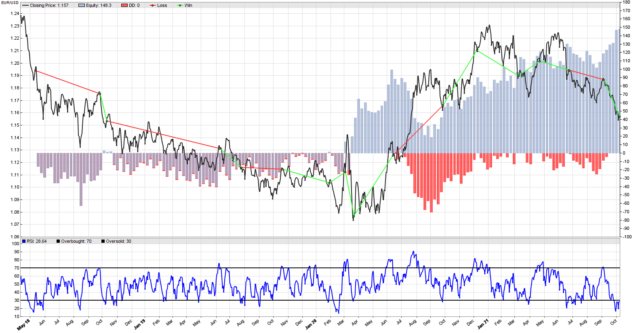

Back-testing in Zorro Trader: the simplest RSI mean reversion on the EUR/USD pair

Well, the equity curve does not look too good. Obviously, we loose money during the first period of the back-test, when the pair trended more than it mean reverted. However, when there was mean reversion, we did make some nice profits. Please note that we also got lucky a couple of times, during the first (downtrend) period. Can you explain how that happened? Hint: look at the RSI plot.

Performance analysis of the RSI mean reversion strategy on EUR/USD

Test MeanReversion EUR/USD, Zorro 2.444 Simulated account AssetsFix Bar period 24 hours (avg 2027 min) Total processed 1377 bars Test period 2018-04-25..2021-10-08 (896 bars) Lookback period 80 bars (22 weeks) Montecarlo cycles 200 Simulation mode Realistic (slippage 5.0 sec) Avg bar 71.3 pips range Spread 1.5 pips (roll -0.10/-0.11) Contracts per lot 1000.0 Gross win/loss 246$-98.16$, +1481.3p, lr 173$ Average profit 42.87$/year, 3.57$/month, 0.16$/day Max drawdown -70.47$ 47.6% (MAE -82.01$ 55.4%) Total down time 80% (TAE 94%) Max down time 44 weeks from Oct 2018 Max open margin 12.10$ Max open risk 12.25$ Trade volume 18450$ (5340$/year) Transaction costs -2.40$ spr, -0.70$ slp, -12.73$ rol Capital required 77.76$ Number of trades 16 (5/year) Percent winning 68.8% Max win/loss 47.77$ / -41.96$ Avg trade profit 9.26$ 92.6p (+223.9p / -196.3p) Avg trade slippage -0.0438$ -0.4p (+0.5p / -2.5p) Avg trade bars 55 (+38 / -92) Max trade bars 171 (48 weeks) Time in market 99% Max open trades 1 Max loss streak 1 (uncorrelated 2) Annual return 55% Profit factor 2.51 (PRR 1.21) Sharpe ratio 0.62 (Sortino 0.68) Kelly criterion 0.70 Annualized StdDev 88.66% R2 coefficient 0.105 Ulcer index 19.5% Scholz tax 39 EUR Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 2018 -33 -2 3 -13 35 -15 -0 12 -13 2019 7 -15 -19 -3 -7 11 24 -19 -11 30 16 -26 -13 2020 26 -12 94 -6 20 17 -74 -16 46 -9 41 -5 +122 2021 14 0 9 34 -26 24 1 -9 44 2 +93 Confidence level AR DDMax Capital 10% 58% 66 73.51$ 20% 50% 79 85.70$ 30% 46% 88 93.77$ 40% 41% 98 103$ 50% 38% 107 112$ 60% 34% 121 124$ 70% 31% 135 138$ 80% 27% 157 159$ 90% 23% 191 190$ 95% 19% 227 224$ 100% 14% 322 312$ Portfolio analysis OptF ProF Win/Loss Wgt% EUR/USD .158 2.51 11/5 100.0 EUR/USD:L .144 1.97 4/4 36.7 EUR/USD:S .162 3.24 7/1 63.3

Conclusion

Wow! Given the aspect of the equity curve, this is a surprisingly good performance report. Half of the time we were under water, but then we managed to get an Annual Return of 55% with a Sharpe Ratio of 0.62. This is not bad at all – for such a simple strategy. If only we could do something about that first period when we lost money, this could be a solid money making systematic trading strategy! Can we? And how? Find some ideas, and learn more about Zorro Trader in our tutorials and Zorro Trader video courses in the members area.

by Algo Mike

Experienced algorithmic and quantitative trading professional.