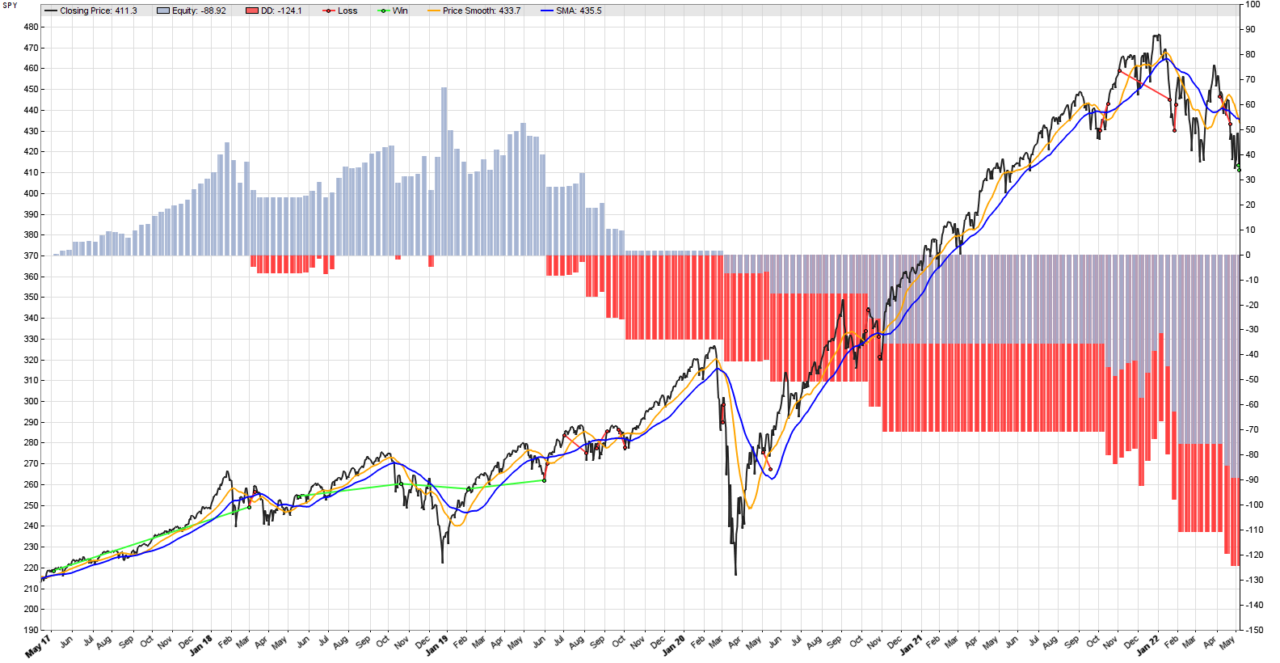

A picture is worth a thousand words, and the picture Zorro Trader produced for us (above) is not pretty. Something happened in June 2019, and after we made some profits, we started to loose money. The strategy did not change, but obviously something else did. And what changed were… the market conditions. But what exactly do we mean by that?

Zorro Trader - Algo Trading Pro - Page 2

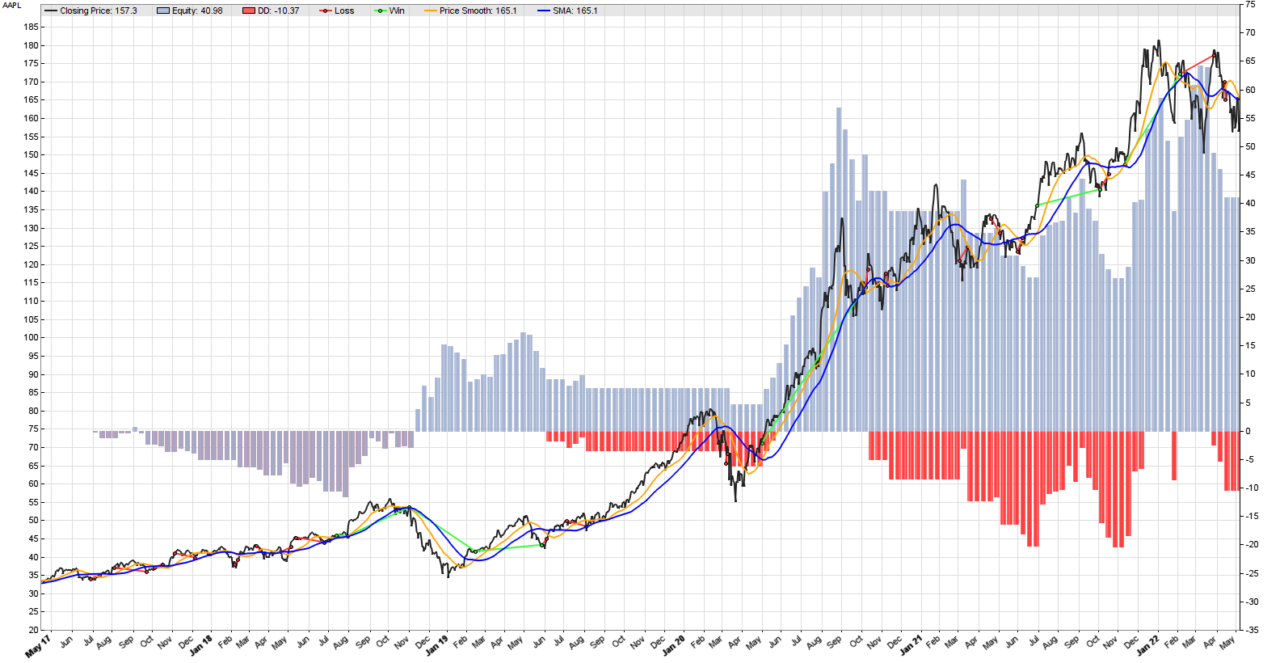

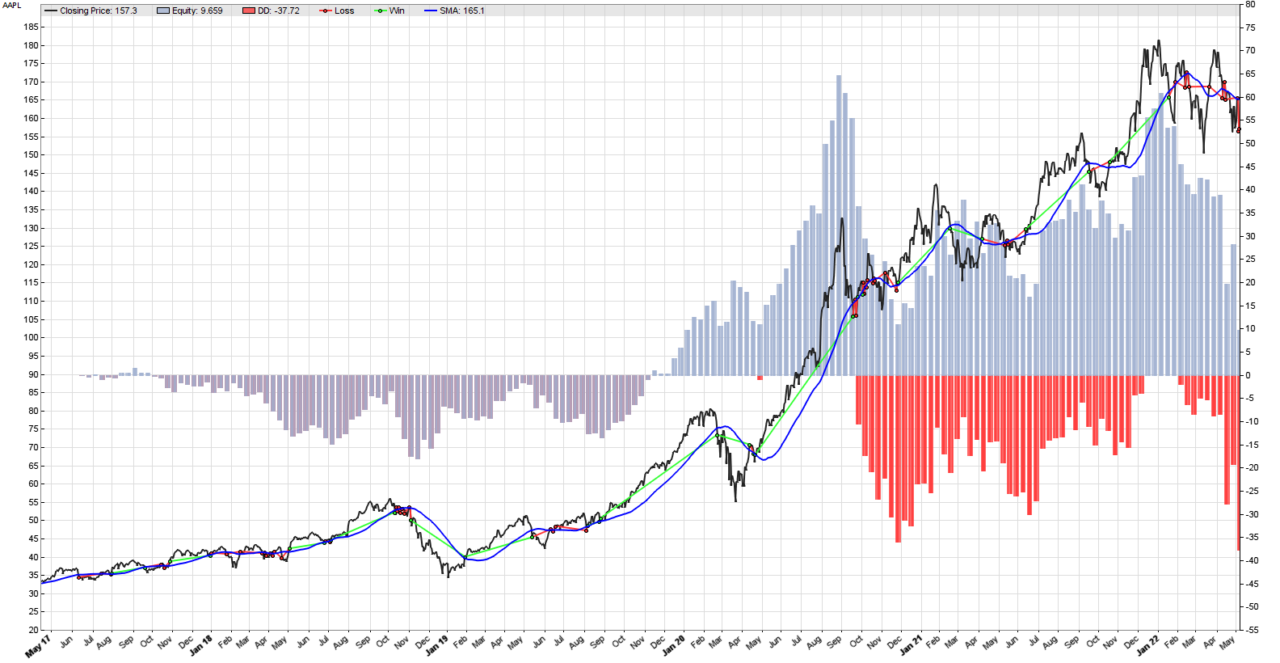

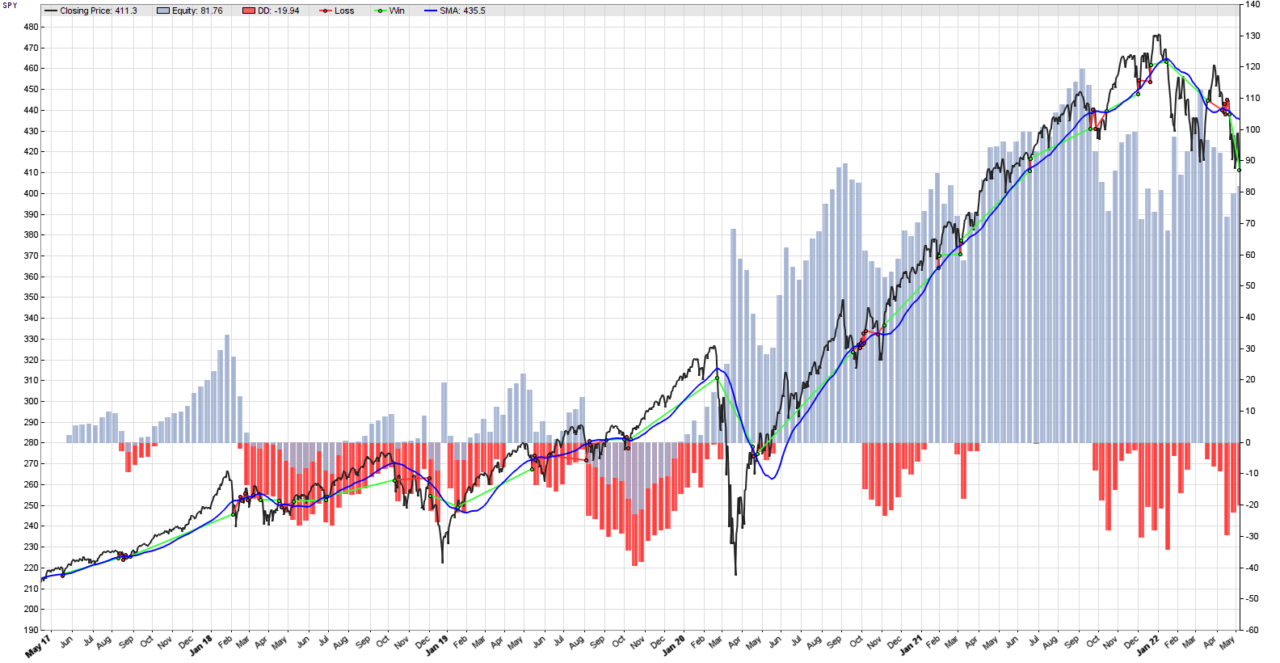

We found that our two moving averages trend following systematic strategy works better with a simple stop loss, or at least it works better on MSFT. In this post, we will experiment with AAPL and SPY. If the new strategy generates improved performance on these securities as well, we may consider this an indication that we are up to something here, and further investigating this strategy makes sense. If not, then we would like to know why. So we will back-test the strategy again in Zorro Trader, but this time for AAPL and SPY. Let’s start with Apple, Inc. The Lite-C code is the same, and the result is in the picture above. The detailed performance review is below.

Some traders believe that a stop loss is always necessary in any systematic trading strategy, primarily as a risk management measure. Other traders believe that a stop loss can do more harm than good, and a well diversified trading portfolio should not need stop losses. Both sides are right and wrong at the same time, but this is a more complicated conversation that goes beyond the scope of this post. Zorro Trader offers a multitude of stop loss options.

For the novice algorithmic trader, we believe a stop loss is necessary, especially when one uses lagging indicators with long formation periods. Moving averages are a good example. A bad trade would end eventually based on your own crossover exit signal, but a stop loss should get you out of the loosing position sooner.

Let’s take a closer look at the bad trades that are destroying our profits in the Microsoft back-test. Clearly, our simple systematic trading strategy works, and Zorro Trader enters and exits trades profitably when a sustained trend exists. The bad trades occur almost always when the price wiggles a lot around the moving average, which usually happens when the market is in a trading range. During those periods, the moving average is almost horizontal (no trend) and the price fluctuations seem to be random noise. But they do trigger a lot of small losing trades, because there is no trend to follow – and it costs us a lot of money.

We will try to back-test our simplest trend following strategy in Zorro Trader for two more underlying assets. We selected Apple, Inc. (AAPL) and Microsoft Corp. (MSFT) because both exhibited fairly long and sustained trends in the past, so they should be suitable for any trend following strategy. Our simplest systematic trend following strategy did not perform very well on the SPY ETF, and we want to compare the performance with these stocks. Here is the full code of the strategy again:

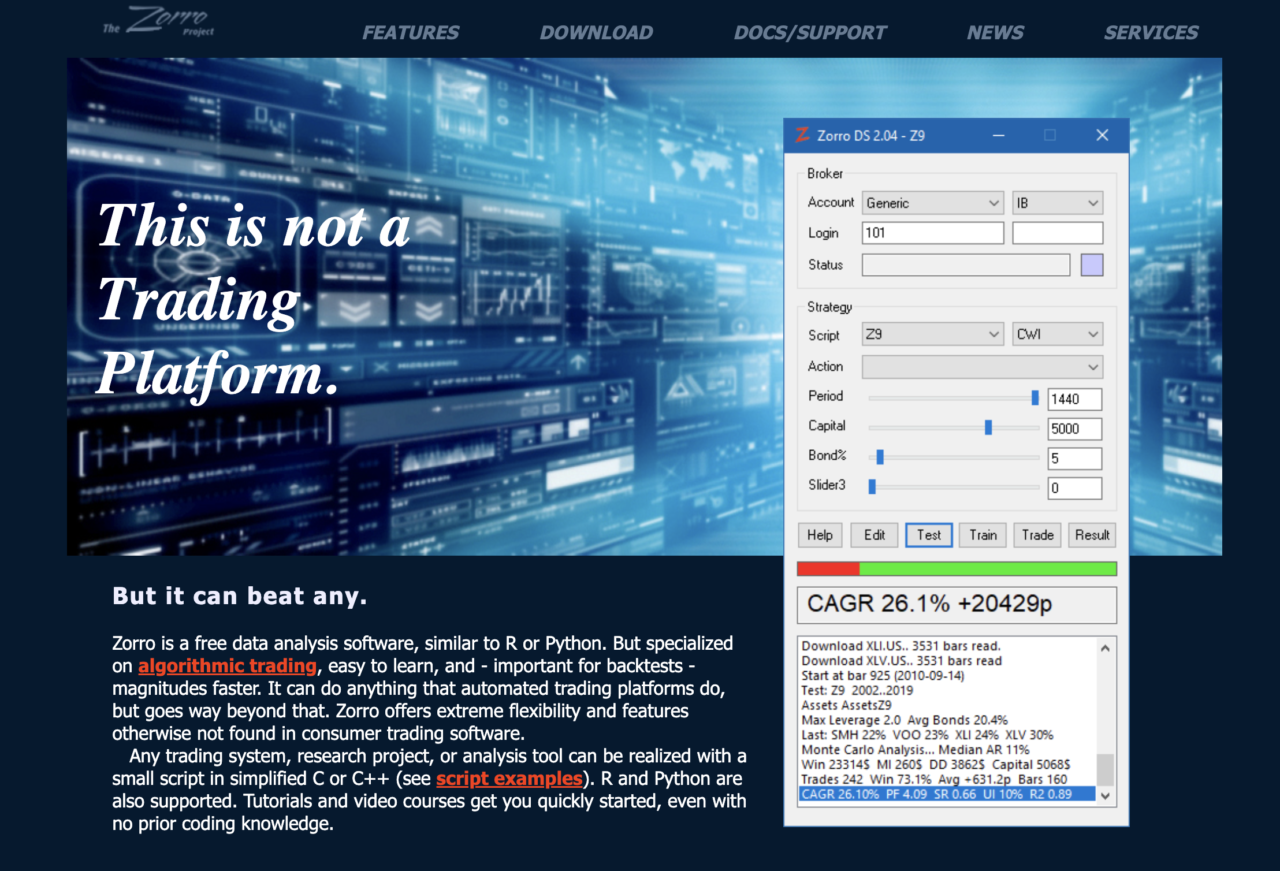

In this post, we will implement the simplest systematic trend following strategy in Zorro Trader, and we will run a back-test to measure its historical performance. The image above represents graphically the output of the strategy in a back-test. The underlying asset in this case is the SPY, an SP500 exchange traded fund (ETF). In plain English, the strategy can be expressed as follows:

Zorro Trader is the most advanced algorithmic trading and quantitative analysis platform available on the market today. It seems the creators of Zorro Trader like to call it a data analysis tool. We will call it an algorithmic trading platform though, and hope nobody will mind. And, indeed, it does beat any other platform we ever used. Zorro Trader is an industry-grade tool that can do anything you could possibly want. From trading strategy research to back-testing and live trading, Zorro Trader got it all. Zorro Trader also comes with a plethora of technical indicators, both new and old, and a great library of statistical tools. Usually, every new version of Zorro Trader adds something more to these features.