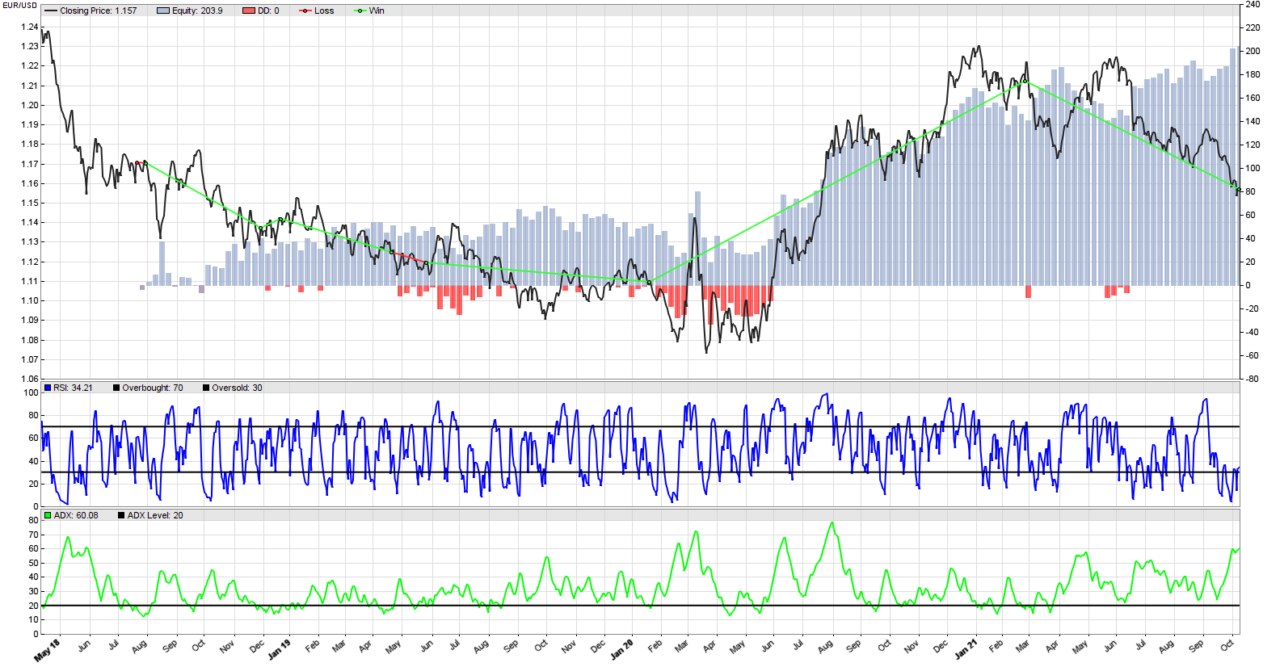

We managed to produce a terrific Zorro Trader back-test of our ADX and RSI trend following strategy on the mean-reverting EUR/USD pair. The equity curve is above, and the trades look beautiful. But the market does not rewards us for beautiful equity curves or impressive back-tests. It only rewards us for creating robust systematic trading strategies that work equally well in the future as they did in the past. And one important condition for that to happen is what we stated before: a strategy should not depend heavily on the values we set for its parameters.

May, 2022 - Algo Trading Pro

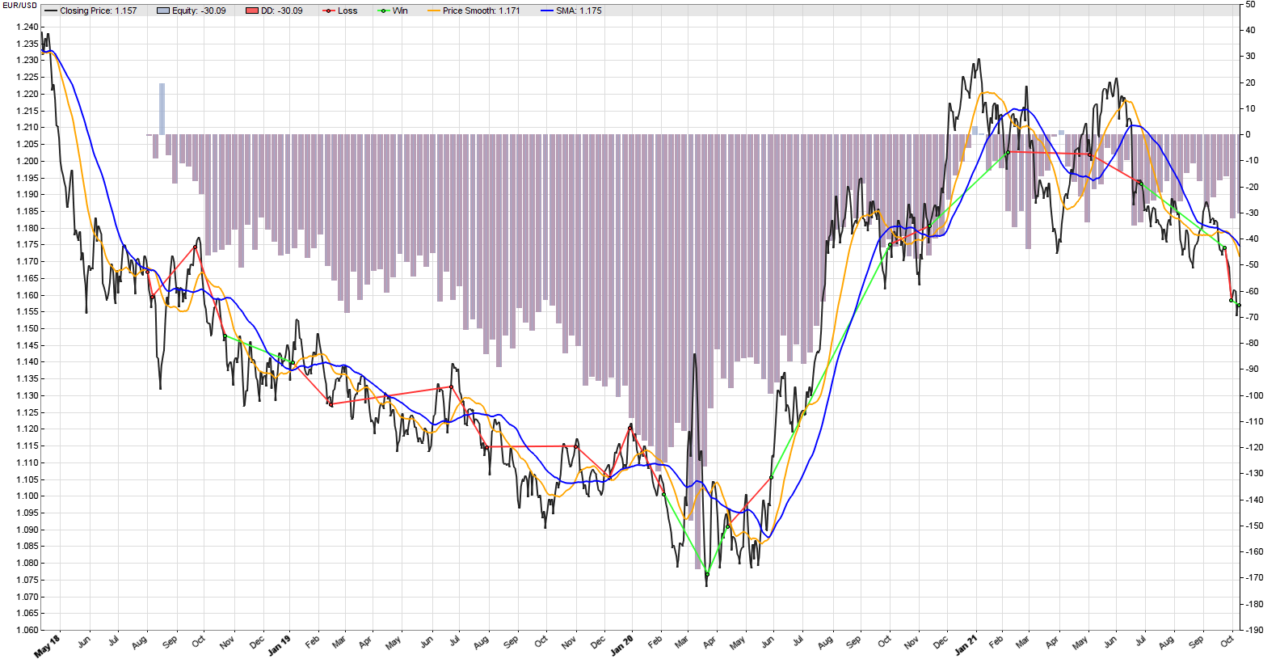

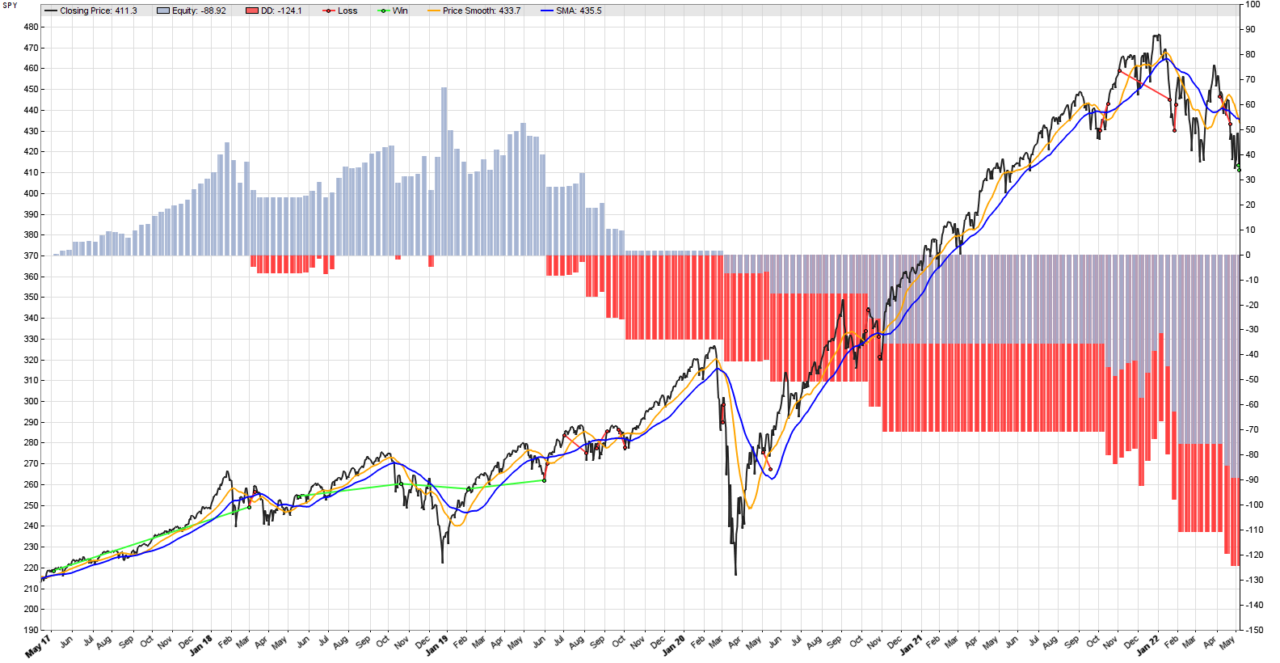

Trend following in mean reverting assets is notoriously difficult. We ran a back-test of our simple two moving averages trend following strategy (25 days and 50 days) on the EUR/USD FOREX pair in Zorro Trader. The result is in the image above. The equity curve looks terrible, and the strategy is on the wrong side of most of the trends. Time series that exhibit some degree of mean reversion do not lend themselves easily to moving averages trading strategies. But we know that there are some profitable trends in the price curve. We see them, but how can we trade them?

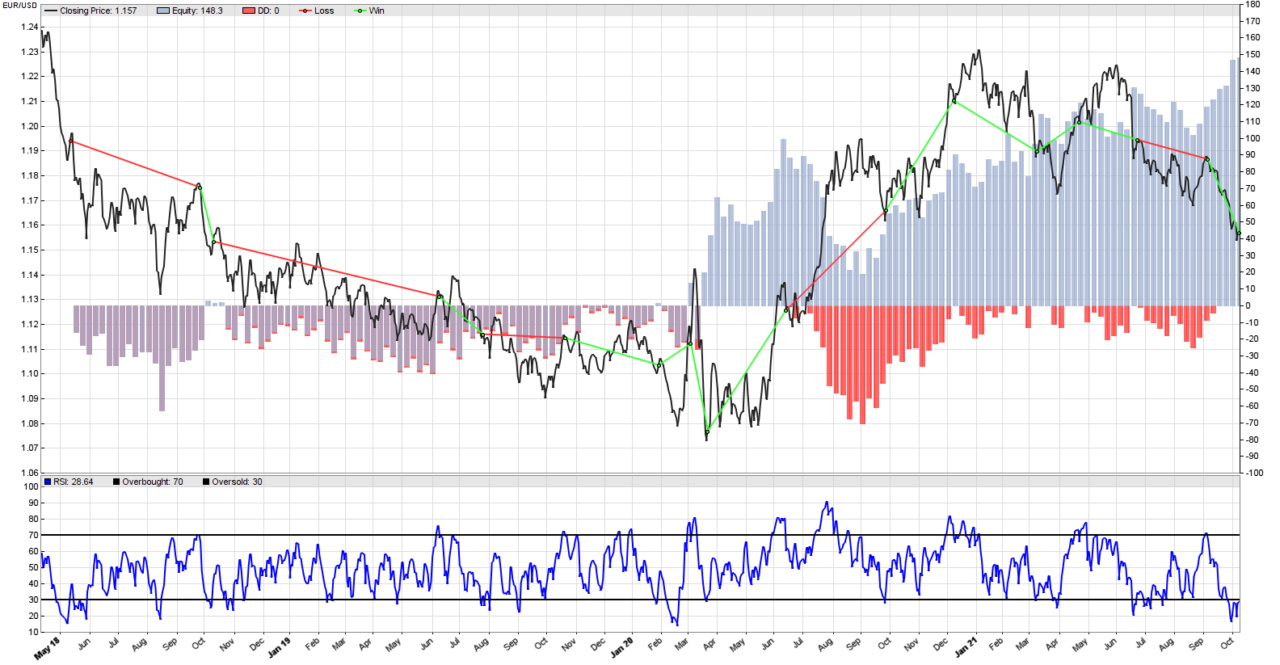

Every algorithmic trading strategy has some parameters. The parameters need to be initialized at the beginning, and maybe changed later. The values we choose for these parameters (arbitrarily or by computation) can have a very large effect on the performance of the algorithmic trading strategy. In this post, we will explore this effect on our simple mean reversion strategy on the EUR/USD pair in Zorro Trader.

Remember the equity curve of our RSI mean reversion systematic trading strategy from the previous post (displayed above)? We were trading the EUR/USD Forex pair, and used a RSI formation period of 10 days. As you know, any technical indicator that needs a formation period will lag. The longer the formation period, the longer the lag. And we know that sometimes this lag can hurt our results. How about we analyze what changes when we change the RSI formation period in Zorro Trader? Maybe we can learn something useful from that.

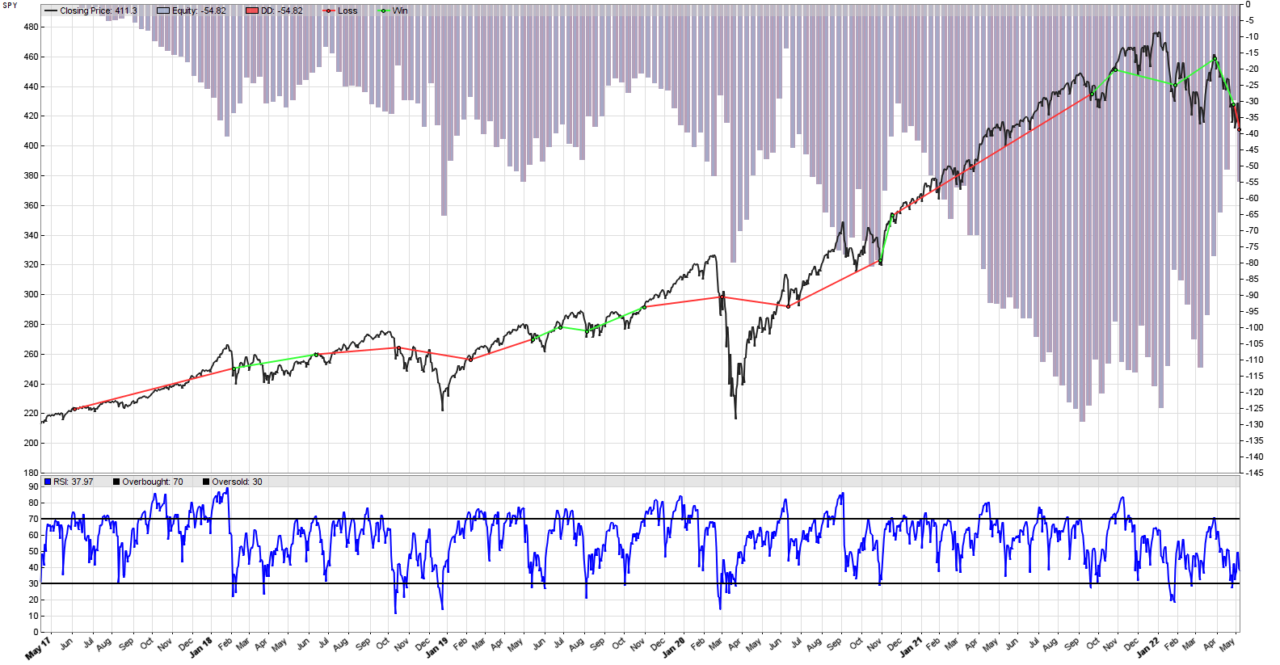

Some assets (like commodities and stocks) tend to trend more than others (like FOREX pairs). In order to investigate the performance of our simplest RSI mean reversion strategy, we will run a Zorro Trader back-test on the EUR/USD pairs. This pair is supposed to mean revert much more than the SPY exchange traded fund. The result of trading the strategy on the SPY is in the back-test equity curve picture above. Not so good during trends, but pretty good in trading ranges.

Mean reversion is the property of a time series to drift away from some mean (like a moving average), but then return to it. In a way, it is the opposite of a trend, which tends to continue for a while. In a sideways market, prices go up and down randomly, but their mean stays pretty much the same. Mean reverting behavior can be observed during some trends as well, but then the mean (moving average) is drifting up or down. Arguably, the simplest way to trade mean reverting markets in Zorro Trader is to use the RSI indicator. The result for SPY is in the picture above.

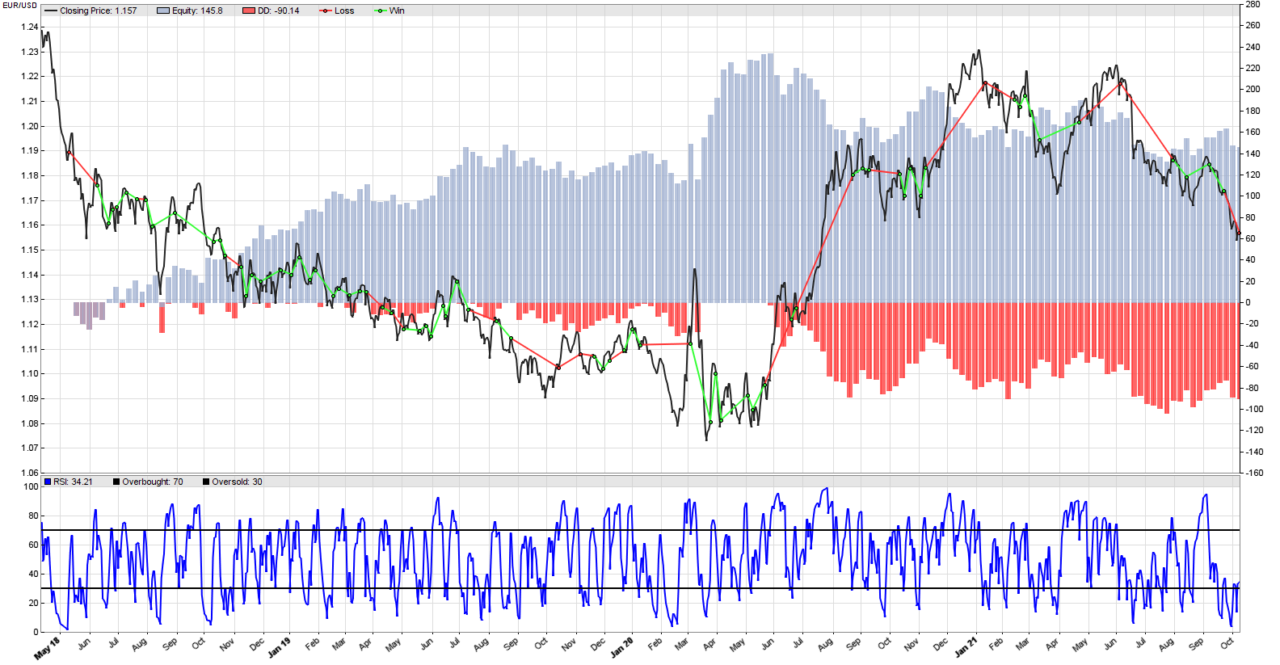

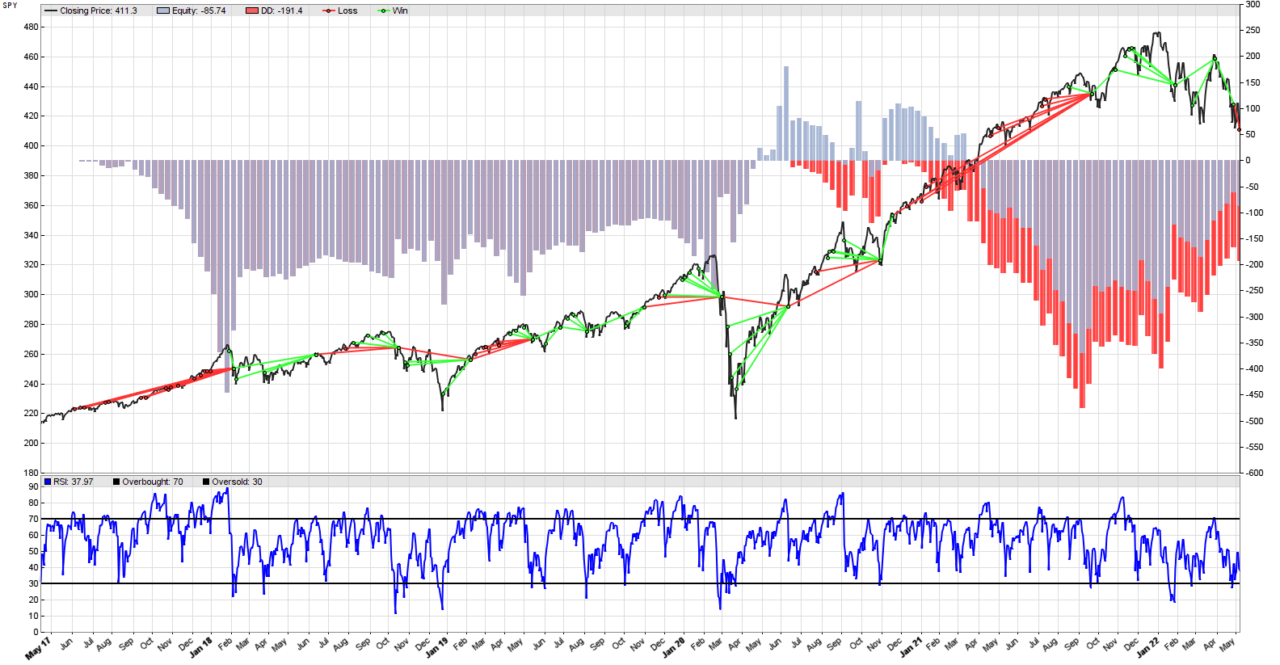

This Zorro Trader Results picture shows clearly that our simple systematic trading strategy stops working in June 2019. All the trades we entered during or after that month ended up loosing money. However, a closer look reveals that the potential for profit was there. If we examine the moving averages crossover signals, it is very easy to see that the signals do capture the trends really well. The culprit jumps to the eye immediately: it is the stop loss.

A picture is worth a thousand words, and the picture Zorro Trader produced for us (above) is not pretty. Something happened in June 2019, and after we made some profits, we started to loose money. The strategy did not change, but obviously something else did. And what changed were… the market conditions. But what exactly do we mean by that?

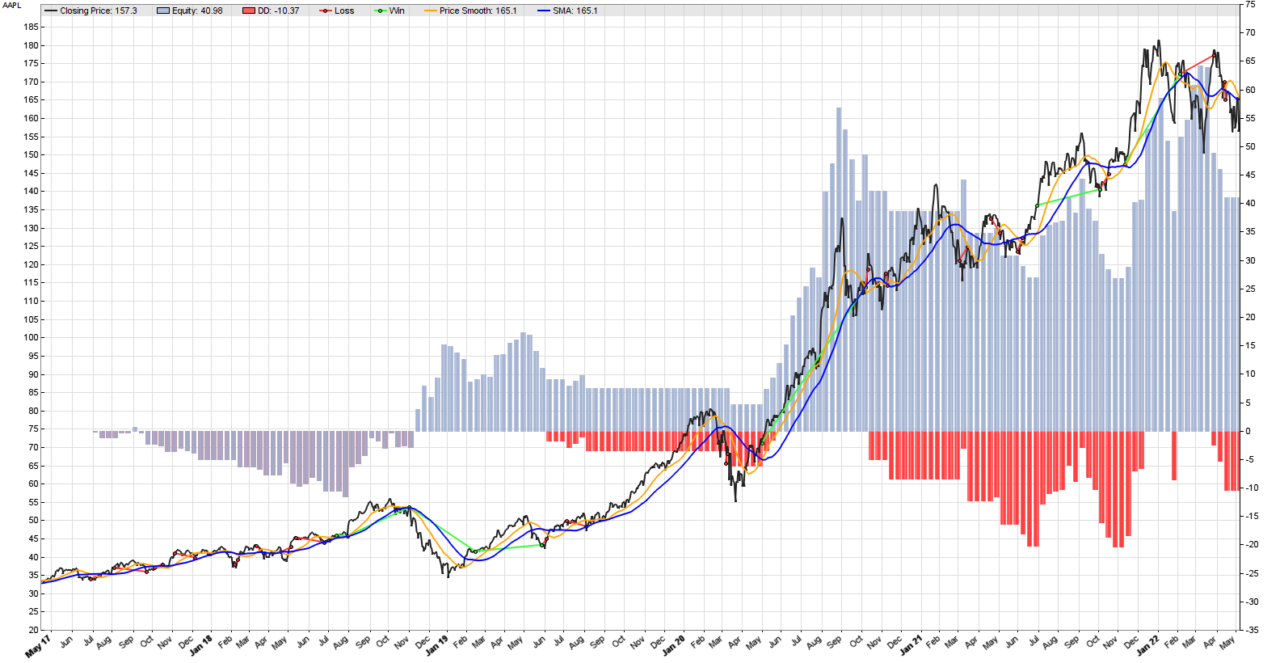

We found that our two moving averages trend following systematic strategy works better with a simple stop loss, or at least it works better on MSFT. In this post, we will experiment with AAPL and SPY. If the new strategy generates improved performance on these securities as well, we may consider this an indication that we are up to something here, and further investigating this strategy makes sense. If not, then we would like to know why. So we will back-test the strategy again in Zorro Trader, but this time for AAPL and SPY. Let’s start with Apple, Inc. The Lite-C code is the same, and the result is in the picture above. The detailed performance review is below.

Some traders believe that a stop loss is always necessary in any systematic trading strategy, primarily as a risk management measure. Other traders believe that a stop loss can do more harm than good, and a well diversified trading portfolio should not need stop losses. Both sides are right and wrong at the same time, but this is a more complicated conversation that goes beyond the scope of this post. Zorro Trader offers a multitude of stop loss options.

For the novice algorithmic trader, we believe a stop loss is necessary, especially when one uses lagging indicators with long formation periods. Moving averages are a good example. A bad trade would end eventually based on your own crossover exit signal, but a stop loss should get you out of the loosing position sooner.